tax loss harvesting wash sale

Buy a cheap call option on the stock you want to sell for a 2021 tax loss. Ongoing year-round tax-loss harvesting provides additional tax alpha by minimizing capital gains taxes.

Tax Loss Harvesting Napkin Finance

For example you currently own 1000 Yazoo shares that you.

. In the United States reporting wash sale loss adjustments is done on the 1099-B form. Wash sale rule considerations Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US. Tax asset creation.

Mondays purchase would now have a cost basis of 50 per share and coincidentally be trading at 50 per share. It occurs when an investor sells a security that has depreciated in value. Watch out for the wash sale rule The IRS wont allow you to sell an investment at a loss and then immediately repurchase it known as a wash sale and still claim the loss.

But you need to familiarize yourself with. Another way to think about tax-loss harvesting. Tax loss harvesting TLH is a technique for generating capital losses.

Then wait more than 30 days to sell the stock. The 10 unrealized gain would be negated by the 10 transferred loss from the wash. Market action in the past couple of weeks has probably caused many investors to begin thinking about selling some securities to harvest losses for tax purposes.

This rule prohibits investors from selling an investment for a loss and purchasing the same or a substantially identical security for 30 days after the sale. Wash sale rule breach - Buying. You can achieve the same goal with a less expensive alternative approach.

To claim a loss for tax purposes. One thing to watch out for. If an investor does buy back that security during the 30-day window the loss will be disallowed by the IRS.

According to Forbes most brokers dont report wash sale WS loss calculations during the year. Youll want to make sure you dont inadvertently participate in a wash sale which occurs when you sell or trade stock or securities at a loss and buy substantially identical stock or securities within 30 days before or 30 days after the sale. In a down market you may consider tax-loss harvesting which can turn portfolio losses into tax breaks.

It applies to most of the investments you could hold in a typical brokerage account or IRA including stocks bonds mutual funds exchange-traded funds ETFs and. An active data-driven tax-loss management strategy maximizes loss-harvesting opportunities and minimizes costs. Tax-loss harvesting is the act of selling an asset that is lower in price than its original purchase price on an adjusted-cost basis.

The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their ordinary income. Understand the wash-sale rule. The wash-sale rule keeps investors from selling at a loss buying the same or substantially identical investment back within a 61-day window and claiming the tax benefit.

The wash sale rule is avoided because December 22 is more than 30 days after November 21. If you buy the same investment or any investment the IRS considers substantially identical within 30 days before or after you sold at a loss the loss will be disallowed. Federal government allows investors to use capital losses to offset capital gains in a current tax year or carry the loss forward into future years where losses can.

Careful analysis of each trade helps ensure portfolios maintain their structure and characteristics without violating wash-sale.

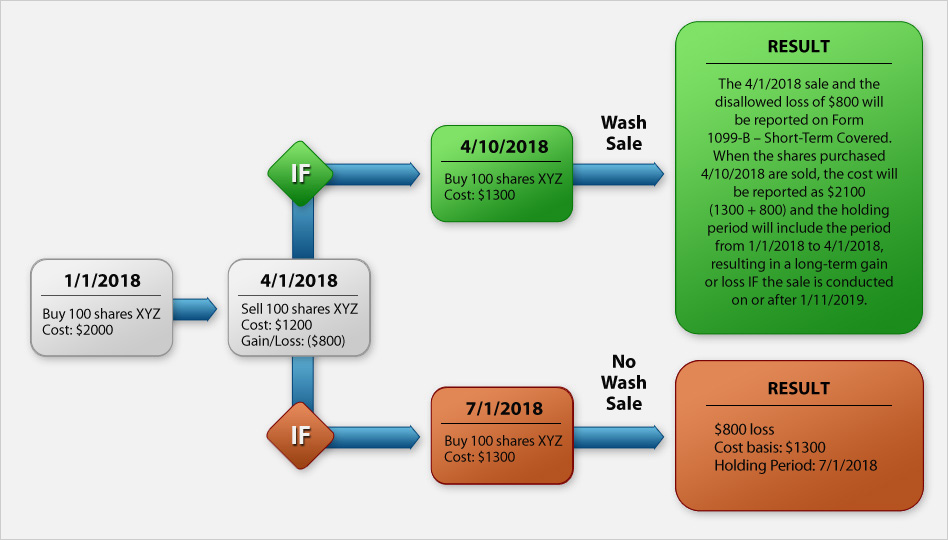

Tax Loss Harvesting Real Example Of A Wash Sale And Irrelevant Wash Sale Bogleheads Org

Tax Loss Harvesting Flowchart Bogleheads Org

Irs Wash Sale Rule Guide For Active Traders

Top 5 Tax Loss Harvesting Tips Physician On Fire

Tax Loss Harvesting Napkin Finance

What Is Tax Loss Harvesting Ticker Tape

Wash Sale Rule What It Is And How To Avoid

Tax Information And Reporting Wash Sales Interactive Brokers Ireland

United States Why Does My Brokerage Show Adjusted Due To Previous Wash Sale Disallowed Loss When I Sold My Entire Position Personal Finance Money Stack Exchange

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Tax Loss Harvesting And Wash Sales Seeking Alpha

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Complete Guide To The Wash Sale Rule 2022 How To Avoid It

Tax Loss Harvesting And Wash Sale Rules

The Irs Untold Secret Tax Loss Harvesting Seeking Alpha

Tax Loss Harvesting Definition Example How It Works

Calculating The True Benefits Of Tax Loss Harvesting Tlh